NFTs have endured bear markets, crypto crashes, and scammers - making headlines, enticing celebrities and setting the tone for a new era in digital marketing along the way. The rush to bring NFT collections to market in 2020 allowed novice marketers to compete against global brands for attention. However, once traditional brands entered the NFT market, massive marketing budgets and formalized marketing tactics followed, changing the competitive landscape.

The 2022 downturn in cryptocurrency markets, cooling off of NFT sales, and recent news of Decentraland's low active user count despite significant investment has some crypto marketers wondering how to adjust their marketing mix to succeed in a web3 world. Crypto-natives and traditional brands approached NFT branding from two very different schools of thought. What can marketers learn from recent NFT branding wins or losses?

Crypto-Native vs. Traditional Brands

Let's begin by comparing the marketing tactics of crypto-native brands such as CryptoPunks to those of traditional brands such as Nike. Have traditional brands outclassed the crypto-natives using brand equity to access large audiences, or have the natives found ways to successfully upset the status quo?

Crypto-Natives Had a Head-Start, But Not For Long

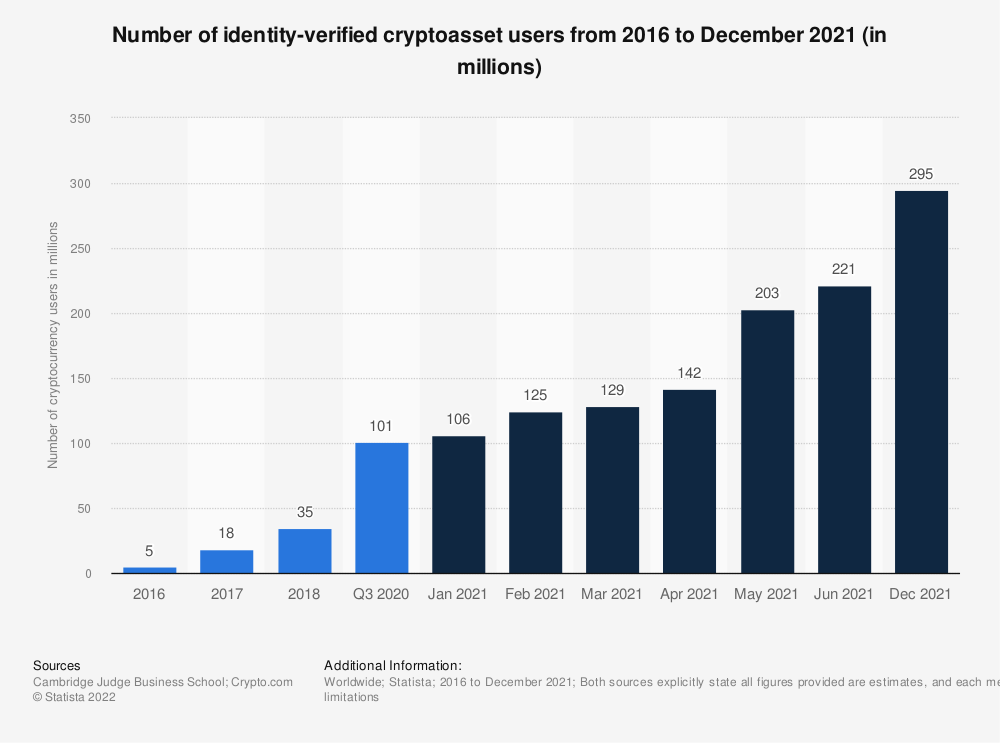

CryptoKitties, CryptoPunks, and Bored Ape Yacht Club all began with a core audience of cryptocurrency users. These consumers either had cryptocurrency wallets or were open to using decentralized finance apps to purchase cryptocurrency. This niche audience was global and willing to spend, but small at only 18 million identity-verified crypto asset users in 2017 when CryptoKitties made its debut. Although 18 million seems like a large audience, it was small compared to gaming platforms Roblox (over 65 million users at the end of 2017) and Fortnite (over 78 million monthly active users in 2018). The small audience and significant barriers to entry for new users kept traditional brands away, allowing crypto-native brands time to deploy their own marketing strategies without pressure from well-developed global brands.

However, it was not long before reports of high value NFT sales attracted the attention of powerful brands such as Nike, Coca-Cola, and Gucci. After all, these global marketing leaders can reference their own historic efforts to capitalize on disruptions in consumer behavior. Interestingly, the May 2021 increase in crypto asset users coincides with Nike's RTFKT / CloneX acquisition in April of that year.

NFT Brand Leaders 2021

As the crypto bull market raged throughout 2021, crypto-native and traditional brands clamored to get their NFT collections to top industry lists with a noteworthy NFT purchase or significant rise in floor price. CryptoPunks won the crypto-native NFT brand crown, achieving some of the highest sale prices to date - five out of the top ten most expensive NFTs are Crypto Punks. Nike emerged as 2021's traditional brand NFT market leader, generating $185.3 million in NFT revenue and $1.3 billion in secondary sales. What did these two groups of marketers do differently during the bull run?

Crypto-Native NFT Brands Ignored Traditional Branding Rules

- Derivative Collections

Traditional branding is typically focused on standing out in a crowded marketplace, with a unique value proposition and discernible personality. However, crypto-native brands know that originality is relative. For example, the floor prices of CryptoPunks derivatives Crypto Phunks (0.29 ETH) and CryptoPunks V1 (5.39 ETH) makes them attractive to NFT collectors who cannot afford to spend 70 ETH or more on a CryptoPunk, but want to identify with the CryptoPunk community. - Free and Low Cost Mints

Many crypto-native NFT collections offered free or low cost minting, making the secondary market upside opportunity look immense depending on the collection's traction. Some only allow minting to those who hold a specific NFT, such as Dayjob Punks, which allows CryptoPunk V1 holders to mint a limited number of Dayjob Punks for 0.017 ETH each. - NFT Buyer Personas

Crypto-native brands recognize that collectors use tools such as rarity.tools, CryptoSlam, and NFTBase to research NFT purchases, and discuss/promote their strategies on Discord, Reddit, and Twitter. Crypto-natives also understand the nuances of NFT price speculation, working on pricing models to encourage "floor sweeping" behavior.

Traditional Brand NFTs Explored the Future of Branding

Make no mistake, traditional brands understand the massive undertaking required to become a household name around the world. Branding behemoth Nike spends billions each year on advertising, with 2022's spend of $3.85 billion dwarfing the entire NFT market.

So, how has Nike specifically leveraged its gargantuan budget, iconic brand, and marketing prowess to secure a foothold in the burgeoning NFT industry?

- Global Press Relations

Nike's global presence is unquestioned. Based on the company's industry dominance, business moves by Nike garner interest from marketers and investors alike. Nike's movement into NFTs may have lifted the entire market for NFTs - bringing non-crypto consumers into the market for the first time, and emboldening competitors such as Adidas to continue expanding their brands into the metaverse via NFTs. - Product Development

Nike's approach to NFTs has been varied, but calculated. Early indicators in 2019 alluded to tokenizing physical shoe ownership, but the purchase of RTFKT and its CloneX project in 2021 made it clear that Nike intended to create a vibrant marketplace for branded NFTs that exist in the metaverse. The company has since reported NFT revenue of $185.3 million, with its RTFKT x Nike Dunk Genesis CryptoKicks collection consisting of over 13 thousand items and total trading volume of 7,514 ETH. - Platform Selection

Although the media frenzy around Decentraland's billion dollar valuation had many marketers buying property in the metaverse, some now see their NFT land valuations plummeting and wonder if they'll ever recoup the investment. Nike however, put its efforts into Roblox - a metaverse with over 200 million monthly active users and in-game currency called Robux. In the first half of 2021, $1.31 billion worth of Robux was purchased on Roblox. NIKELAND on Roblox has already attracted over 6 million people from 224 countries since November 2021.

What Can They Learn From Each Other?

Both crypto-native and traditional brands are striving for NFT market leadership, but neither has a clear path to success during this formative stage in web3 marketing. What can these two learn from each other?

Crypto-natives teach traditional brands to listen to the NFT community, and to entice NFT collectors with pricing models that allow for speculation and community growth. Traditional brands show the natives where to look for new audiences, and to consider making an impression on younger digital natives to inspire life-long brand loyalty.

How do you think the future of NFT marketing will unfold? Join us on Twitter to share your thoughts!